This blog was forwarded to me by one of my Wholesale Property Investors, Brandon Mitchell from his Investor Carrot web site. Timeless information for anyone interested in Investing in Real Estate. Thanks Brandon:

We talk with lots of people looking to buy real estate investment properties in Cape Coral and surrounding areas. Some of them know what they’re doing… and some of them are still in the learning process.

But, since our entire business is finding great deals… and often passing those deals onto real estate investors like you at huge discounts… I thought it would be a great idea to share with you some resources on how to effectively evaluate a real estate investment deal. This works in any market… Cape Coral, surrounding areas, florida, any other states across the country.

When you really boil it down… evaluating a real estate deal is a pretty simple process. If you’re looking to buy real estate as an investment, wholesale properties, hold them for rent… whatever, one of the most important parts is buying it right (i.e. – not overpaying).

So lets dive in.

How To Evaluate A Real Estate Deal – (for single family houses)

There are just a few main elements when you’re evaluating a deal.

- Cost of repairs needed to get it back up to good condition

- The after repair market value of the property (what it’s worth and can sell for today once it’s fixed up)

- If you’re going to buy and hold for a rental… you need to know what you can rent it out for and what your “debt service” (mortgage payment) will be. Knowing this makes sure you’re buying so the property cash-flows each month

There are other things you can (and should) look at too… but those 3 are the main important things to look at first.

Cost of Repairs

One of the things you should do when you are looking at a property is find out how much it’ll cost you to fix it up to a point where it’s in great shape. In other words, the cost of repairs. This could be a new roof if it needs it, carpet, paint, a new kitchen, yard, maybe even more.

To find a good estimate of cost of repairs, the best advice we have is to get to know a contractor or two in your area and have them walk through the properties with you the first few times… have them quote out the repair cost… and build that into your offer.

After Repair Market Value

This is simple, but many investors get stuck on this part. This is essentially what you could sell the property for today… after you repaired it and brought it up to a great condition. This is found by finding out what other similar houses in the same area are actually selling for. NOTE: Don’t look at the “Listing” price… look at what houses similar to yours have actually sold for in the past 3 months. This helps you determine how much you could actually sell that house for if you had to… right now. You never want to over pay to a point where you can’t sell it for a profit in the next 3 months.

How do you find this? There are services out there that can help you with this… but often times the best way to find out the true value of a house is to talk to a Realtor that you know… or an appraiser. Heck, if you don’t know one… call up a few today… tell them you have a property that you’re potentially going to sell in the near future… and ask them what they think it should sell for.

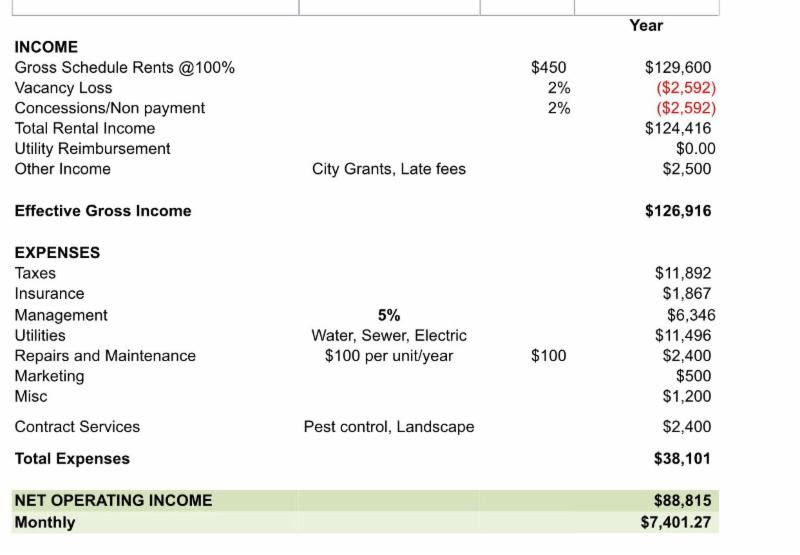

Buy And Hold For Rental

So, you’re going to buy and hold for rental? Great! You don’t need to worry about what it’ll sell for right away. What you need to know is if it’ll pencil out on a month to month basis. You know… cash flow.

So, talk to a mortgage broker (or a private lender) and find out what the monthly mortgage payment will be for that specific property.

Then find out what you can rent the place out for on a monthly basis.

Then, you work backwards… and find out at what purchase price your mortgage payment will be low enough so you can make the monthly cash flow you need to make on the property. Be sure to figure in other expenses too like property taxes, maintenance expenses, property management fees, and keeping money in reserves for future repairs.

So, your offer price here should be:

Monthly Mortgage – Monthly Rents – Operating Expenses – Taxes & Insurance – Monthly Cash Flow = Offer

Simple enough right?

The cool thing is, the more you’re bringing into the deal in cash… the lower your mortgage is.

Making An Offer

We’ve been talking about how to look at the numbers and analyze a real estate deal.

From there, just make an offer. Many times the properties we let you know about will already be so deeply discounted that we get multiple offers… often above our asking price.

So, if you really want a property… find out what is the bare max you could buy the property at… and offer that. Otherwise you may lose the deal because someone else is likely making an offer too.

With that said, the golden rule in real estate is to never over pay for a property. That’s why our own deal analyzing criteria is so darn strict… and why our buyers (like you) get such great deals.

I hope this little tutorial has helped you sharpen up your real estate deal analyzing skills… and we really look forward to working with you in the near future.

If you have any questions at all… don’t hesitate to contact us anytime for anything.

Happy investing!